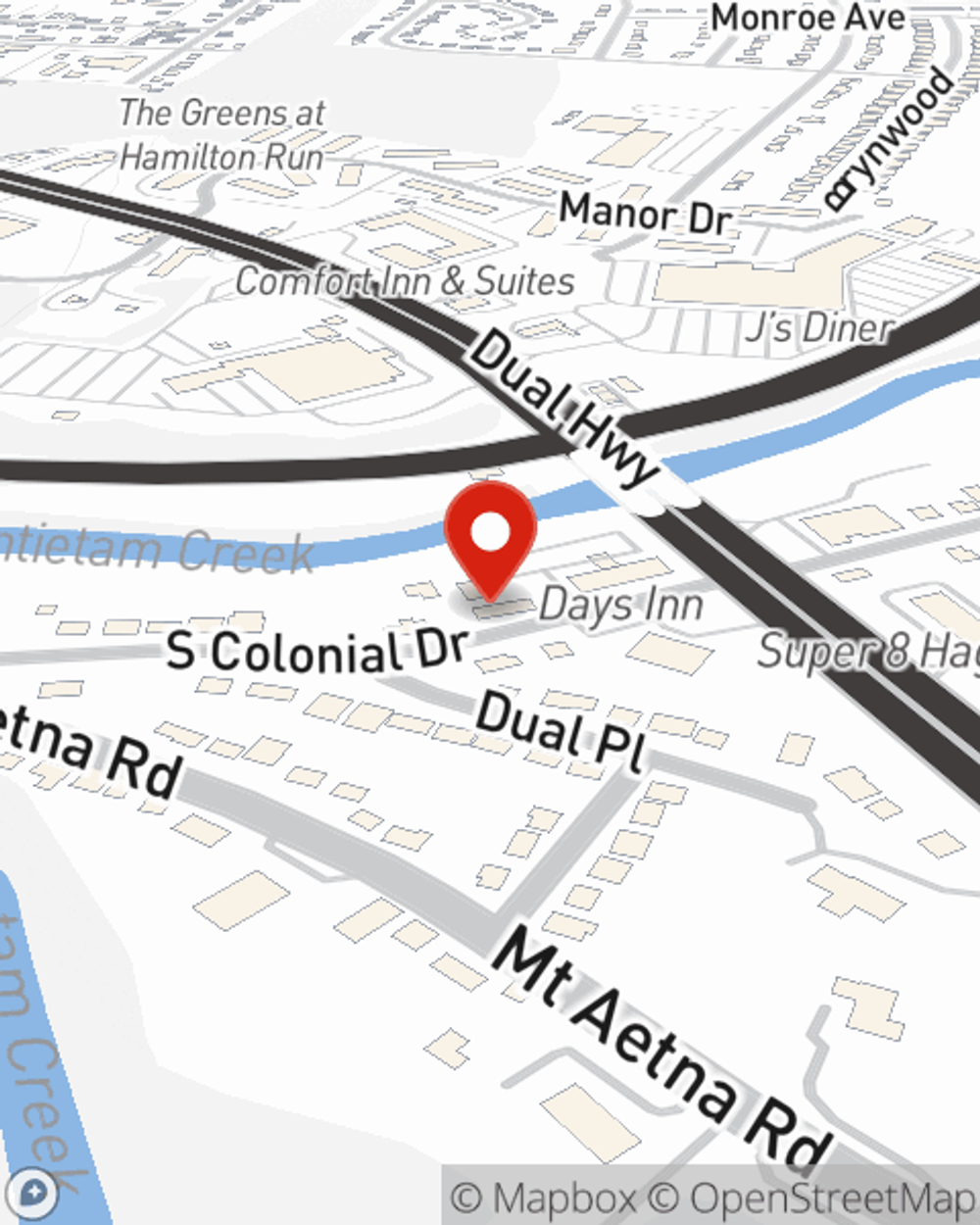

Life Insurance in and around Hagerstown

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

Protect Those You Love Most

It can be a big deal to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can keep paying for your home and/or maintain a current standard of living as they grieve your loss.

Coverage for your loved ones' sake

What are you waiting for?

Love Well With Life Insurance

You’ll get that and more with State Farm life insurance. State Farm has fantastic policy choices to keep your loved ones safe with a policy that’s adjusted to correspond with your specific needs. Luckily you won’t have to figure that out on your own. With deep commitment and excellent customer service, State Farm Agent Tom Breidenstein walks you through every step to create a policy that protects your loved ones and everything you’ve planned for them.

Simply get in touch with State Farm agent Tom Breidenstein's office today to find out how a company that processes nearly forty thousand claims each day can help cover your loved ones.

Have More Questions About Life Insurance?

Call Tom at (301) 797-5493 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Tom Breidenstein

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.